Since 2019

Operating in London, UK and Australia.

The long-term interests of our clients are structurally aligned with Marvefxgroup interests as a private, independent, employee-owned investment manager. We don't have an external parent, public shareholders, or other lines of business that could divert us from our primary goal. We are truly in this together because our employees and their families have invested alongside our clients, and because 100% of employee deferred cash compensation is directly linked to team and company strategies.

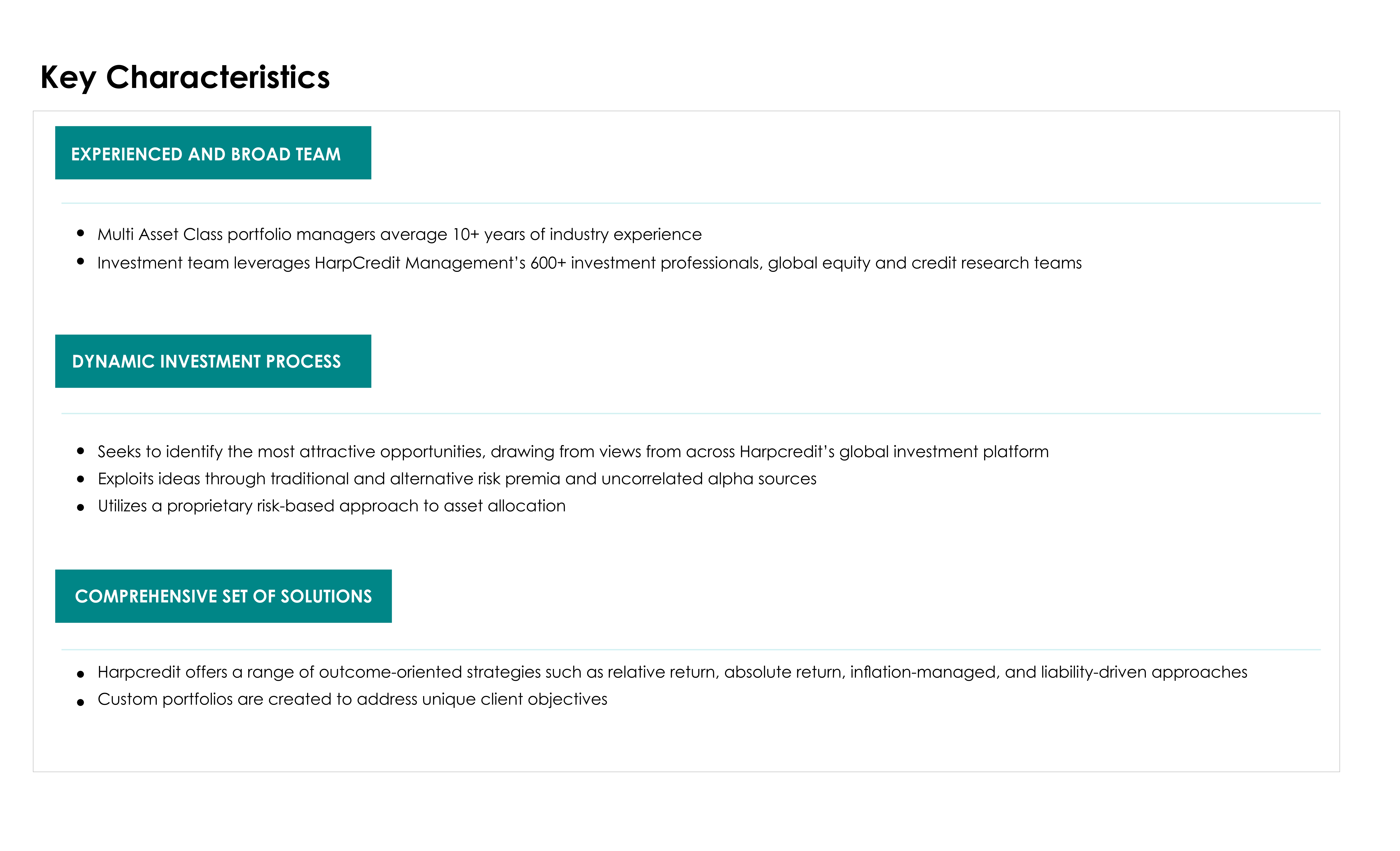

Marvefxgroup manages a variety of equity, fixed income, private equity, and hedge fund strategies on behalf of institutions, advisors, and individual investors globally from offices in 15 cities across 10 countries. Marvefxgroup has assembled a diverse group of individuals dedicated to client outcomes and investment excellence, including more than 250 investment professionals and over 1,100 total employees. We have enviable retention rates among our senior investment staff thanks to our culture.

Marvefxgroup was established with one goal in mind: to provide long-term, compelling investment results for our clients. This still serves as our sole objective today, motivated by a culture built on in-depth fundamental analysis, the pursuit of investment insight, ongoing innovation on behalf of clients, and the open flow of ideas throughout the company. We are invested in businesses that form the backbone of the global economy, supporting the endeavors of individuals, corporations and governments worldwide.

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case." — Robert G. Allen

Growth of Our Company

OUR PLEDGE TO YOU

In order to ensure that the resources from our strategy, philanthropy, wealth and investment teams are integrated as best we can, we will create a dedicated working team in collaboration with your Financial Advisor. Many of our clients have turned to us for solutions in which their full range of assets, business interests and debt are part of the overall financial objectives. Others prefer the new methods and specific tasks we offer, which allow individual clients to invest alongside institutions from all over the world. Our value will increase as your needs improve. We want to be part of your inner circle so we can help you solve the challenges that make you feel most stressed, whatever they are.

Serving our customers

Being a valuable asset management partner: that same commitment comes from our three parallel businesses, each meeting the unique needs of clients.

Asset management developments

We are taking a keen interest in the hunt for Alpha. To enhance the success of investors, we are able to provide various information and different solutions through a unique combination of expertise across all divisions, consistent revenues, and alternatives for multiple assets and an interconnected global network.

Research and trading

For better results, Wall Street leading independent marketing and consumer research firm delivers research on reliable investment and trading performance.

Private wealth management

For the most expensive people, families and small institutions we offer sophisticated asset management tools and expert advice that will help investors to make their money meaningful.

WHAT SETS US APART

Differentiated insights

Different ideas promote different aspects that are translated into a number of new solutions for each allocation, fixed income, alternative and multiple asset plans.

Responsibility

At MFG, we make and invest in commitment, in order to make a better outcome for our clients, communities we serve, and as well as the world around us.

Trust

Marvefxgroup is incredibly proud of the faith our clients have placed in us, and we make every effort to uphold that honor on a daily basis. Each client will receive a personalized level of service from us, and we are dedicated to helping them make successful investments. In an initial assessment, our personal advisors sit down with new clients to go over their goals, objectives, and investment strategy in detail. This not only influences investment decisions but also fosters an honest and trustworthy client-advisor relationship.

Private wealth management

For the most expensive people, families and small institutions we offer sophisticated asset management tools and expert advice that will help investors to make their money meaningful.

Culture

At MFG, the tradition is always in place. We are working every day to develop a diverse, inclusive and interconnected culture which will enable everyone to become a much better person. A great financial success is often accompanied by a great deal of complexity. Our task is to help clients understand this difficulty and then work out solutions that will meet their needs.

Dedicated focus

We're committed to becoming your main partner, whether you are an international institution, financial advisor or a high value person. We're always looking for alpha in all heritage classes, so that you can achieve greater success.

Carefully diversified

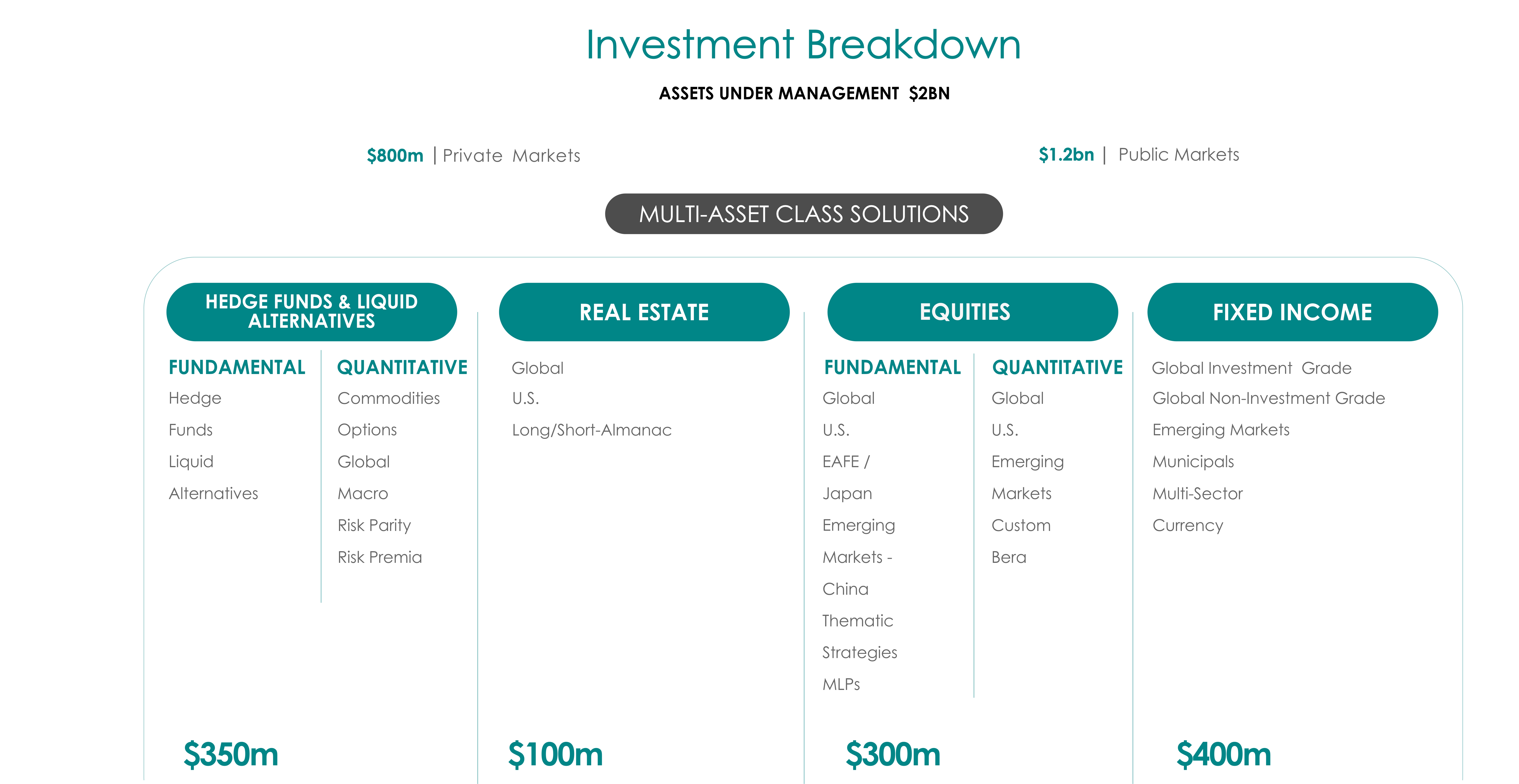

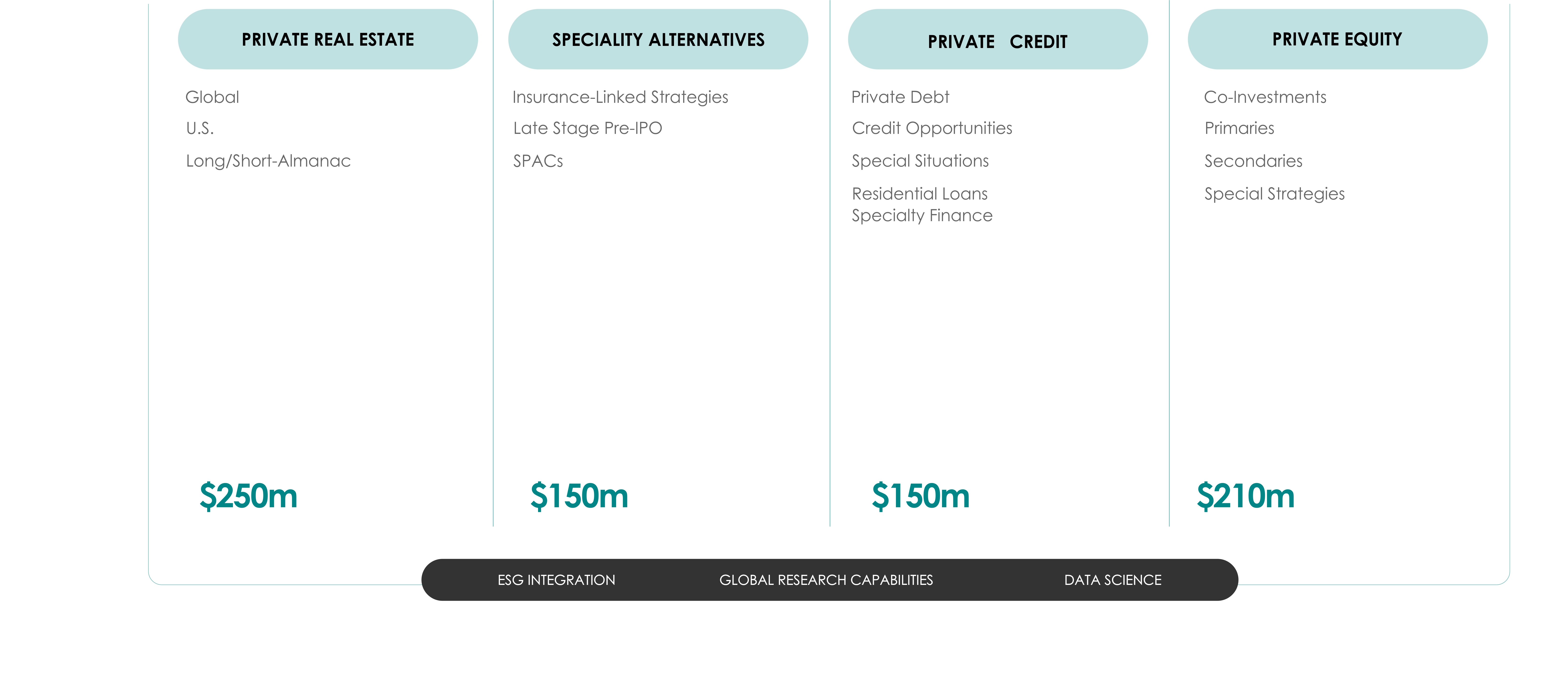

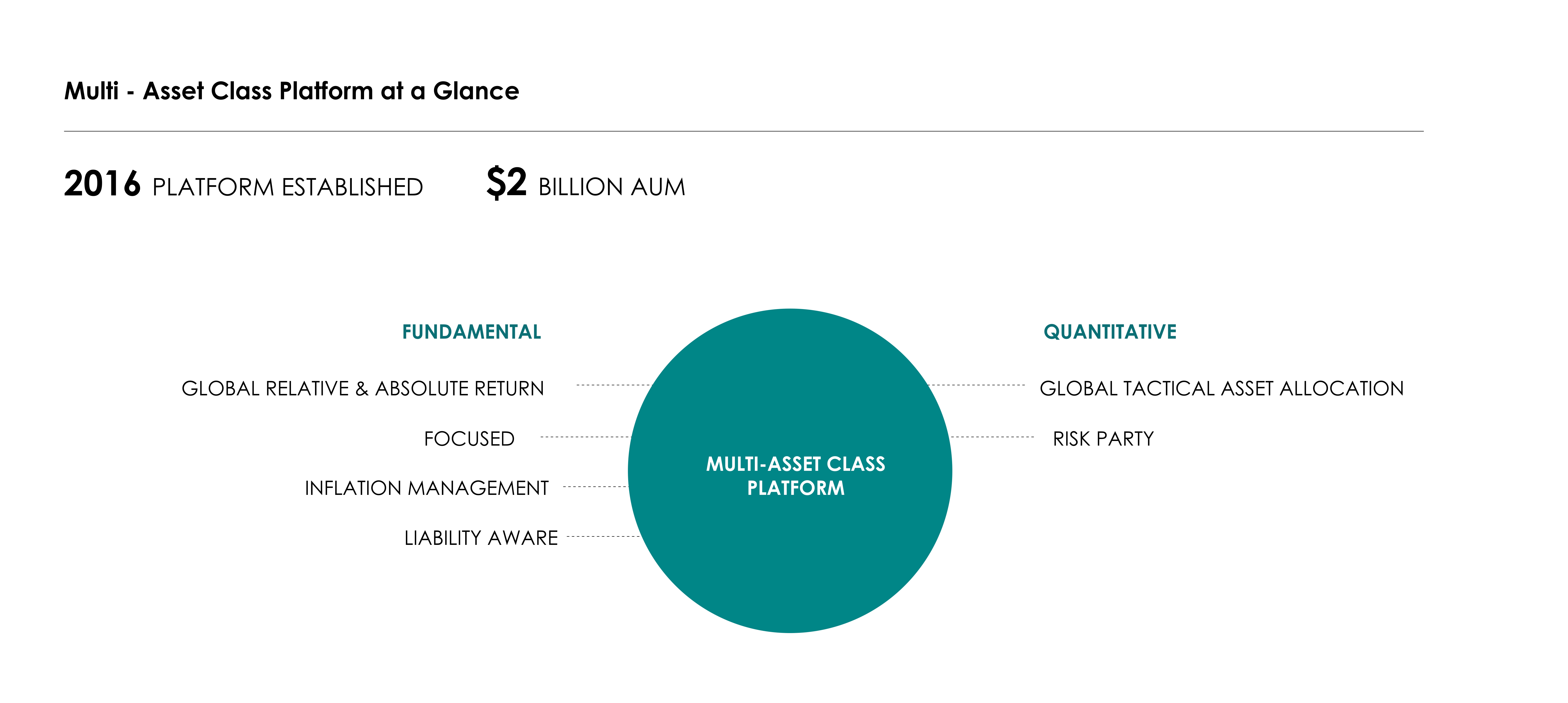

Since the future is a mystery, we concentrate on enjoying it to the fullest. Our strategy for diversifying our assets and allocating assets is based on a single, clear insight. There isn't always a single asset class or investment strategy that performs better. No manager is excellent at everything. This narrative appears repeatedly in history. Our multifaceted strategy is guided by this realization. With extensive knowledge in non-traditional asset classes like infrastructure and private equity—over 170 asset categories in total—our expertise goes far beyond traditional stocks and bonds.

Communication that works for you

Whether you prefer phone calls, e-mails or face-to-face meetings with some of your professional advisers, such as a librarian or a lawyer — we are delighted to welcome you. In a lot of companies, the people managing your finances don't even know you or your advisor. However, our advisors are in direct contact with portfolio managers making day to day decisions on behalf of our clients. This gives us a chance to combine efforts, especially when it is of great importance.

Responding to risk

We can be very sensitive to risks because we have a complete understanding of our clients' portfolios. Investment is also about flexibility and emotion, but emotional investments can cost you a fortune. To help you better manage your strategy for the long run, we have created a dynamic asset allocation (DAA) that helps stabilize your portfolio.

WHATEVER YOUR NEEDS

The focus of attention is on customers, not managers. With our flexible investment platform, we will be able to deliver a proper mixture of new solutions, depending on your situation, goals and needs.

Versatile delivery

We work with clients in both capabilities — individually or collectively — and managing our portfolio includes honest monitoring across our field.

What makes our approach truly integrated is the seamless integration of forecasting investment in wealth and research. Our models make decisions real, enabling clients to see how they can achieve their goals of living a lifetime, helping those in need or keeping the wealth for generations.

A sense of your goals and values is what we begin with

We have got a variety of wealth desires among our clients. So we're going to prioritize the things you care about first. So we take the results of over 10,000 possible outcomes, we are replicating thousands of possible scenarios with the Marvefxgroup Wealth Forecasting System as we work through your different scenarios to estimate your future wealth.

Finally, we've drawn up a list of results that will allow us to create your main budget. Compared to how much money could be managed to grow, this is a safe bet that can be earmarked for savings.

Help you make better decisions

We do assist our clients to assess whether they can meet their objectives, while we're not sure how things will turn out. First and foremost, wealth strategy focuses on your interests. In large markets, having an investment strategy gives you an edge and makes a strategy rich.

Knowing what you need

We offer the most appropriate asset management and wealth planning opportunities by thoroughly comprehending each client's individual investment objectives and concerns such as investment duration or income tax requirements. Exclusive investment vehicles are available from Marvefxgroup to suit the requirements and objectives of each client.

Returns on sustainable investments

The majority of our clients favor making cautious, low-volatility investments to grow their wealth. We create the right strategies and use carefully chosen investments to meet their needs. A value-oriented investment strategy is used by Marvefxgroup, which places a strong emphasis on consistent and predictable cash flow as well as the exclusion of investments that result in a decline in purchasing power.

Long-term investing: being patient, disciplined, and intelligent

By investing with a five-year or longer horizon and using objective intrinsic values, we can profit from the fear and greed that drive short-term market prices as long-term business owners rather than traders or speculators.

Since the beginning, we have remained committed to the long term, despite the fact that the majority of investors' time horizons have significantly shrunk. We are friends with volatility as long-term, bottom-up, fundamental business appraisers because it makes time horizon arbitrage possible. We have the chance to acquire discounted, high-quality businesses run by partners who create long-term value as a result of short-term market price disruptions. Because Marvefxgroup is an independent, employee-owned business and that our employees make up our single largest client, we are able to maintain our long-term discipline even when it is challenging to do so. However, having a clientele that will think and act long-term is just as important as being a long-term investor. By investing alongside our clients in our funds, terminating our strategies when doing so would be in the best interests of our shareholders, and maintaining ongoing open communication, we have positioned ourselves to serve our clients. We are fortunate to have amassed a sizable clientele with whom we have been able to successfully pursue our strategy for a long time.

Transparency

When clients have questions, we take pride in providing concise and accurate answers. Every customer has the ability to check the status of their account at any time from any secure internet connection. Advisors are equally approachable; they are constantly available to talk about specific issues as they come up.

Putting everything together

Putting everything together, the Marvefxgroup System creates portfolios that contain various, contrasting points of view. Due to their diversity, portfolios have the potential to perform well in a range of market circumstances.